March 6, 2024

Time Blocking Techniques: A Guide for Financial Advisors

Are you maximizing your efficiency and client satisfaction as a financial advisor? A survey revealed that while the majority of business owners (63%) work more than 50 hours a week, they would prefer to work just 42 hours. Time blocking is a strategic time management method that can help you align your work habits with […]

January 31, 2024

Financial Advisor Value Statements: A Key to Client Relationships

Did you know that according to a survey, only 36% of the U.S. workforce was engaged in their organizations in June 2021, with 15% actively disengaged? The lack of engagement often results from the absence of a clear value statement, while employees dedicated to a greater purpose tend to be more engaged. In this guide, […]

October 31, 2023

How to Mitigate Transference and Countertransference Issues

Did you know a striking 97% of employers value soft skills as equally or more crucial than hard skills? This insight significantly applies to the financial advisory domain. Top-performing financial advisors excel not only in financial acumen but also in soft skills like emotional intelligence and client relationship management. These skills are vital in navigating […]

September 27, 2023

How to Use Behavioral Finance Concepts in Coaching Clients

Did you know that Daniel Kahneman, a Nobel Prize-winning expert, found that people’s money choices are 90% emotional and just 10% logical? This significant finding underscores the vital role of behavioral finance—a field that delves into the psychological underpinnings of our financial choices. For financial advisors and coaches, understanding these emotional drivers is essential. What […]

February 2, 2022

Not Sending a Meeting Agenda Is Costing Your Financial Advisory Practice

Creating and sending an agenda to clients ahead of meetings is one of the best ways to set expectations, keep the meeting on track, and make sure both you and your client show up fully prepared. However, many financial advisors who want to make meeting agendas often give up on the idea because it seems […]

January 12, 2022

Miller’s Law for Financial Advisors: Why You Need to Make a Habit of Sending Follow Up Emails

The advice you give as a financial advisor is perhaps the most valuable element of the service you provide. But if a client doesn’t understand your advice or forgets it within an hour of leaving the meeting they had with you, the value of that advice diminishes quickly. That’s the problem you have to contend […]

May 19, 2021

The Forgetting Curve and the Vanishing Value of Financial Advice

Forgetting information we learned is a natural part of life. However, as financial advisors, this process can make it difficult for clients to keep track of the topics discussed and the recommendations we provided. Without that memory of our financial advice, clients will struggle to realize just how much value we’ve created for them. In […]

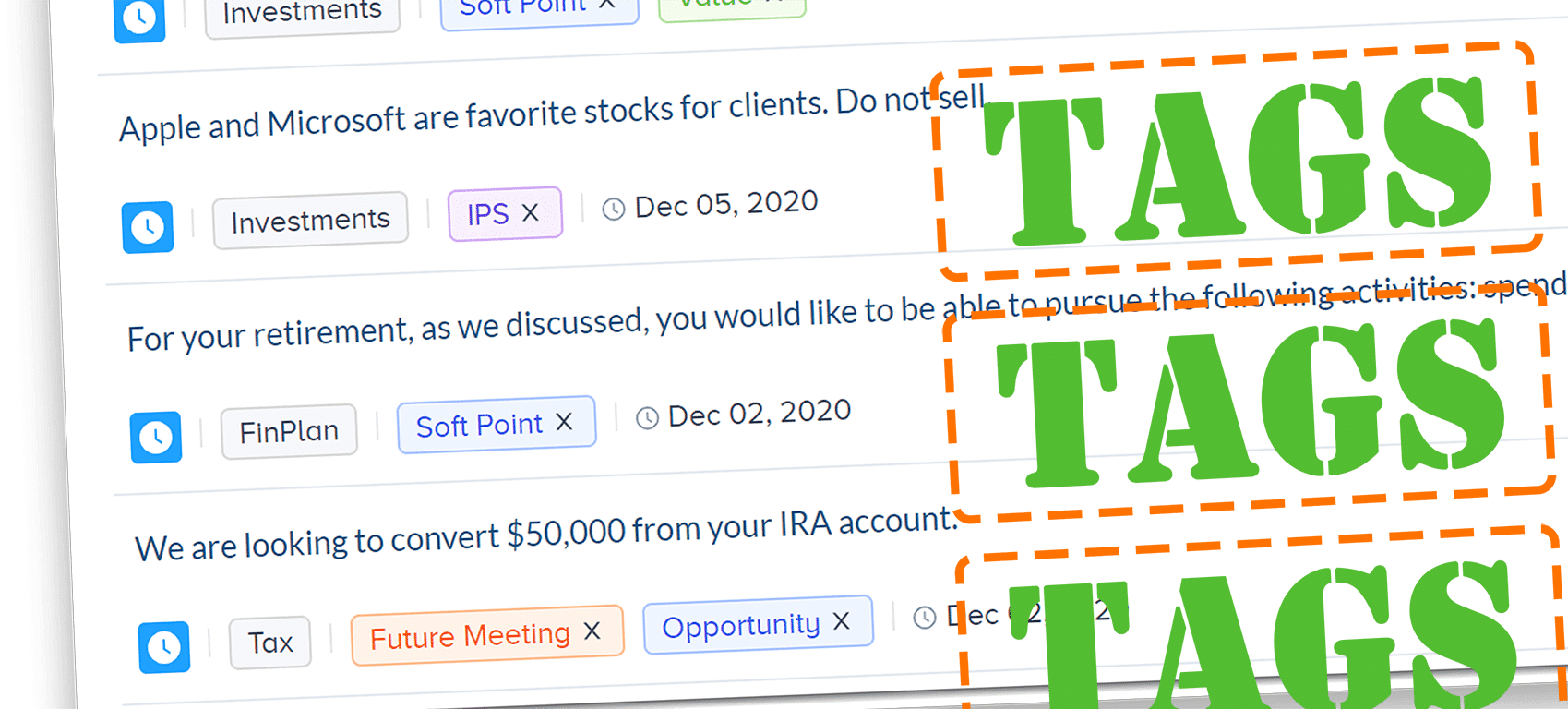

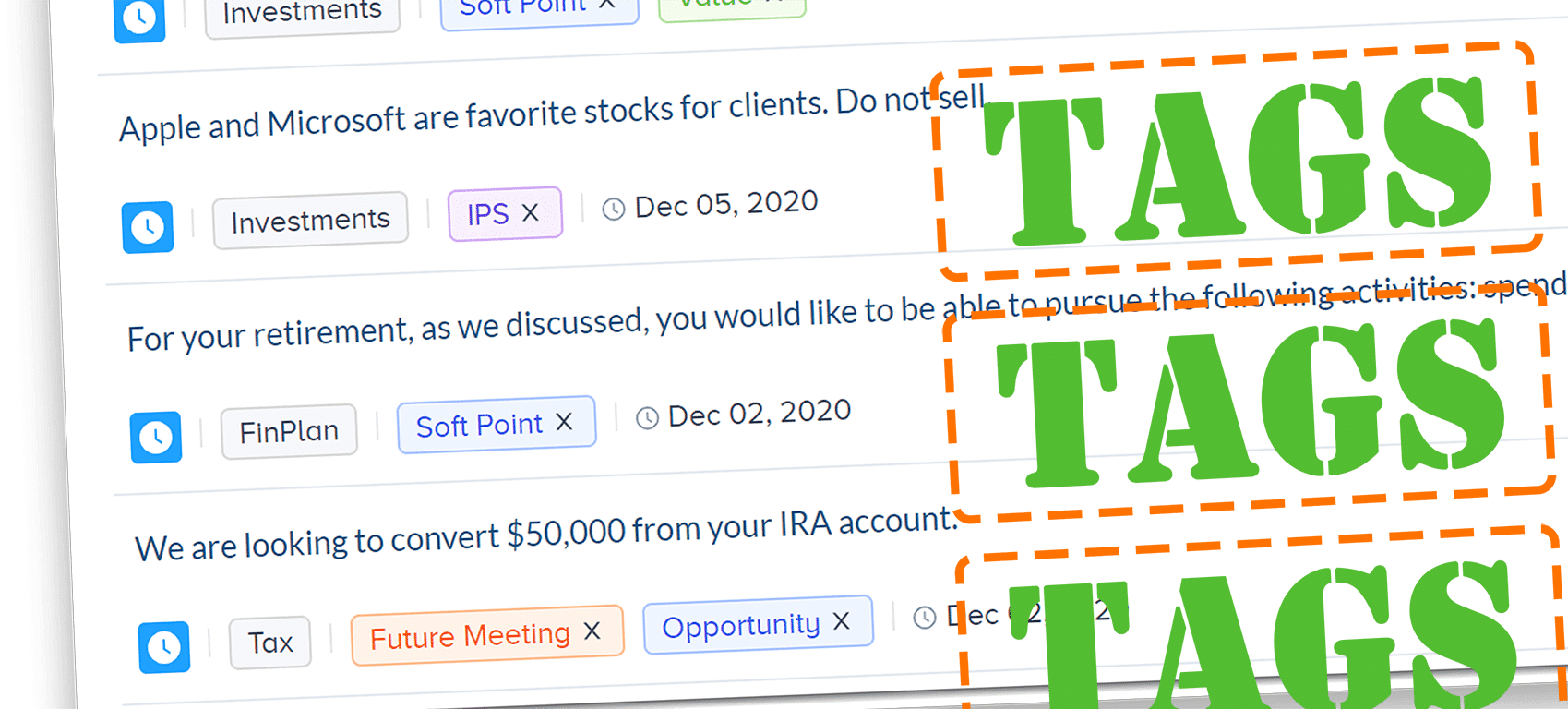

December 8, 2020

Use Pulse360’s New Tag Feature to Keep Your Financial Advisor Practice Organized

How do you keep track of the important nuggets of information that you uncovered during a client meeting? When you promise to address a topic at the next meeting, how do you make sure you remember to put that topic on the agenda? Do you create tasks for yourself so that you’ll be reminded later? […]

August 13, 2020

What’s Changed for Financial Advisors amid the Covid 19 Crisis?

As markets reel in response to the recent pandemic, the financial advisory industry faces a host of uncertainties. Clients are seeking advice and reassurance, while advisors have their own worries and investment challenges. As well as finding new ways to deal with clients, advisors have had to navigate administrative issues and furlough or even make […]

July 8, 2020

5 Ways to Future-Proof your Financial Advisory Practice

Advisors have been thrown in at the deep end when it comes to technology so here's how to future proof your advisory business and boost productivity