I hope you get value out of this blog post.

When a client is going to retire is something that as financial advisors, you are usually aware of. What is unknown is which market cycle are we going to be entering when that particular client retires. And as it stands, that is more important than the 4% withdrawal rule. We have all heard about the 4% withdrawal rate and the arguments for it and against it. I have utilized it for years as a back of the envelope calculation when out and about. It is great for that.

When are they retiring? Not as in age, but market cycle point. If markets are on a correction phase, 4% would likely be too high. On the flip side, if markets are on a bull run (as in the past several years), 4% may be too conservative.

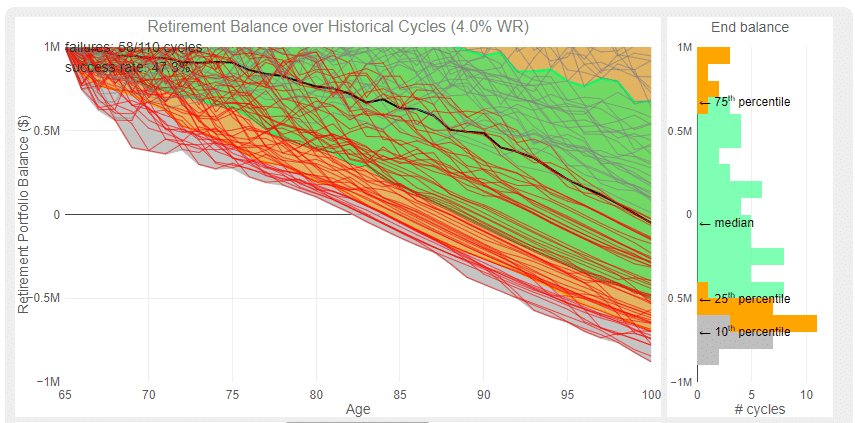

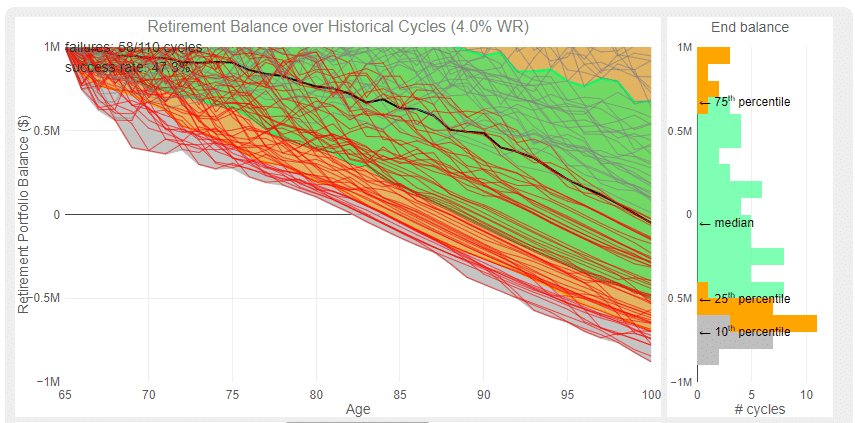

The next several years are going to be critical to plan for your clients. I came across a site today that I wanted to share with you all. I ran some standard numbers to get a visual representation of what would have happened historically during various market cycles.

Basic Assumptions - This is NOT a Monte Carlo simulation

Each line indicates a different retirement start year - goes from 1871 to 1980. Red lines indicating unsuccessful runs. A powerful visualization of retirement start date vs market cycle stage.

Now I understand, this is not very scientific and many of you will point that out. You can tactically manage the allocation and can go more aggressive in recovery years and so on. I just thought it was an interesting exercise and share the link to the amazing website with you: https://engaging-data.com/visualizing-4-rule/

[thrive_leads id='753']

I am not an economist or a CFA trying to predict a bear market. We have had several years of a great market run and we all know at some point that is going correct itself. Prepare your clients that are going to be retiring in the next few years to have a cushion for this eventuality. As you are well aware, recovering from a drop of 24% (20% correction plus the 4% withdrawal) will be a challenge. That is where your value is over Robo-advisors.

Help your clients be prepared and capture your value.